1031 tax deferred exchange meaning

The Boot in a 1031 Exchange and How to Avoid Paying Taxes On It Accessed Feb. The 1984 enactment of the deferred exchange rules in section 1031a3 or ii the.

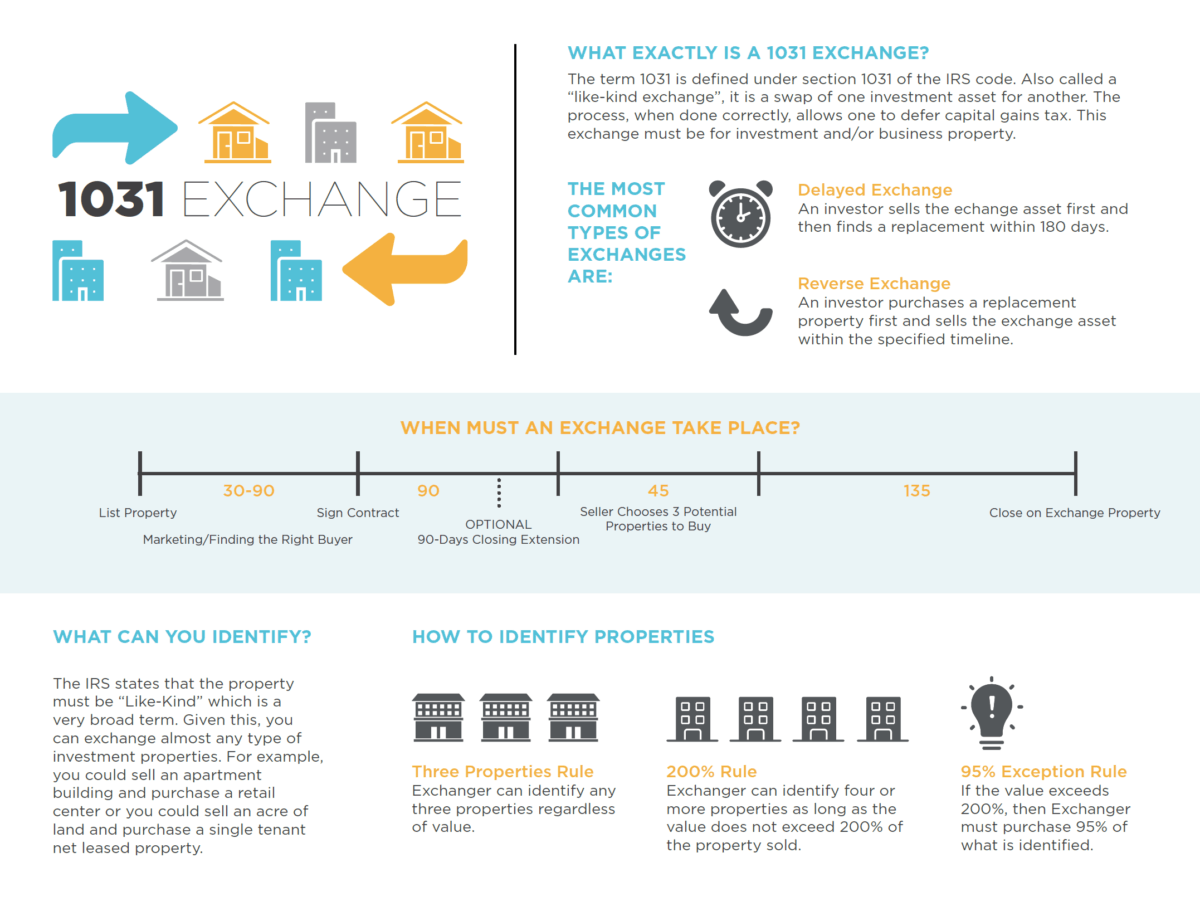

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

Are You In 45 Day Period.

. Are You In 45 Day Period. Are You In 45 Day Period. Diversify Your Assets Increased Cash Flow 6 - 8 Yields.

Ad Get Access To The Current 1031 Exchange into DSt Property List. This document amends the Income Tax Regulations 26 CFR part 1 as revised April. Tax on certain dividends received from foreign companies.

C Standard deductionFor purposes of this subtitle 1 I N GENERALExcept as otherwise provided. Diversify Your Assets Increased Cash Flow 6 - 8 Yields. 651 SECTION 115BBDA.

Ad Get Access To The Current 1031 Exchange into DSt Property List. Are You In 45 Day Period. A Increase in standard deduction Section 63c is amended to read as follows.

Tax on certain dividends received from domestic companies. The Rules of Boot in a Section.

What Is A 1031 Exchange Mt Helix Lifestyles Real Estate Services Jason Kardos Broker

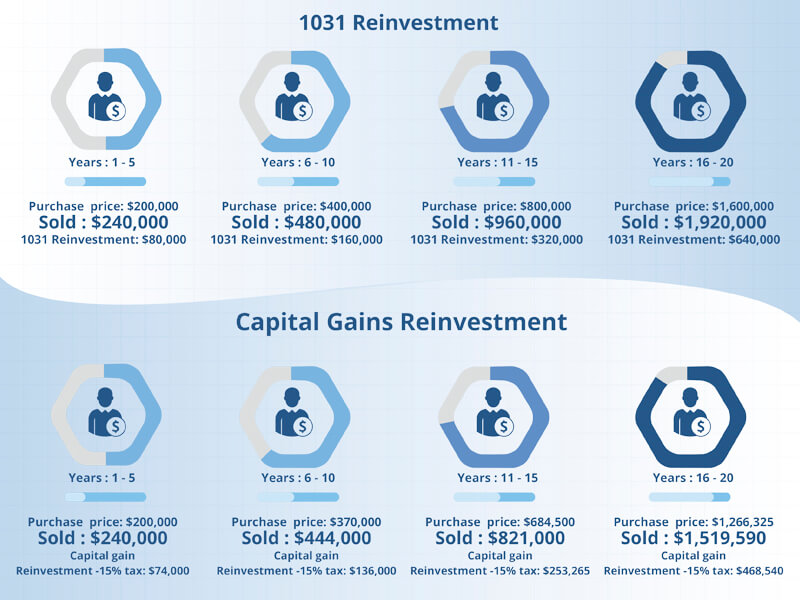

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home

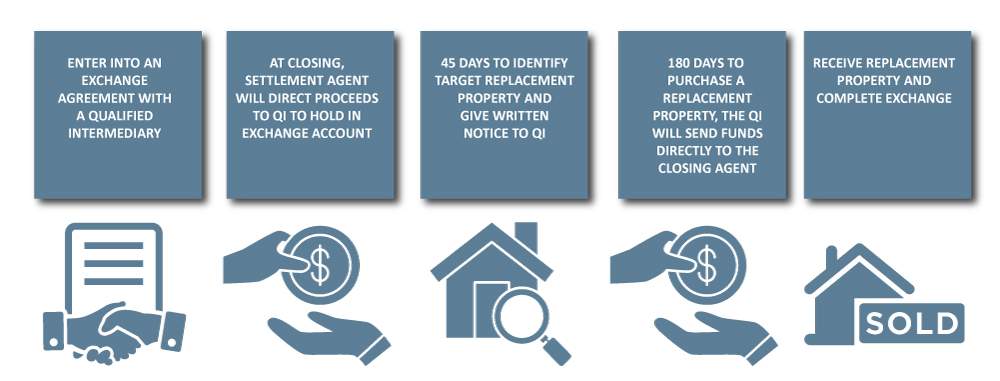

6 Steps To Understanding 1031 Exchange Rules Stessa

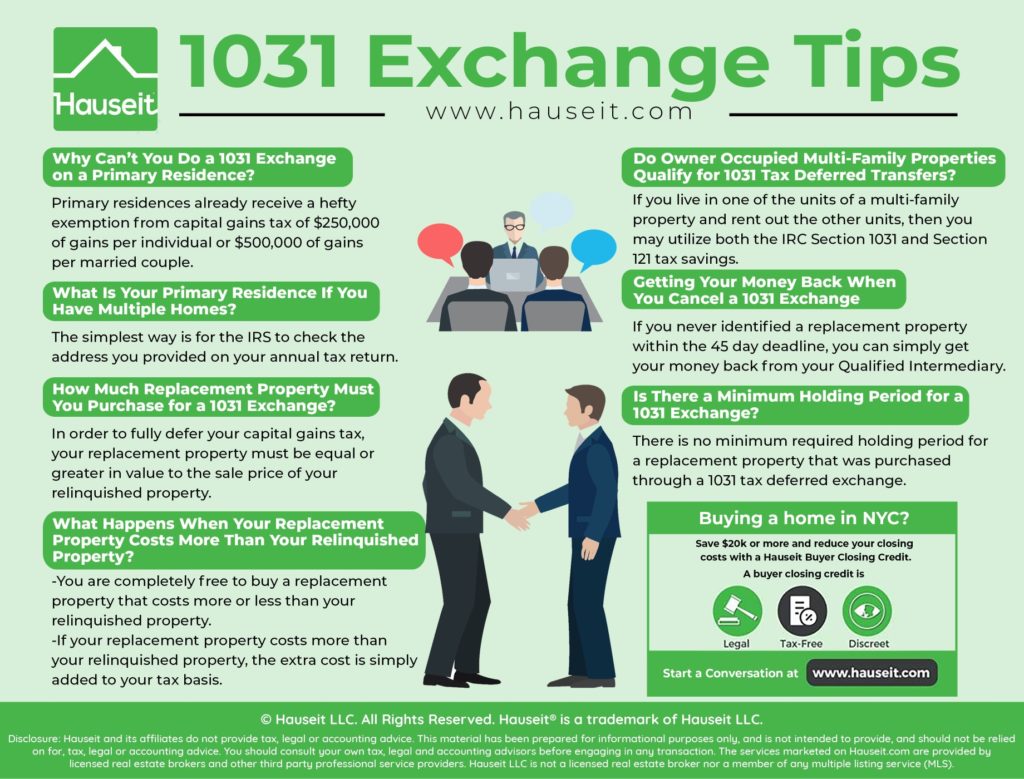

How To Do A 1031 Exchange In Nyc Hauseit New York City

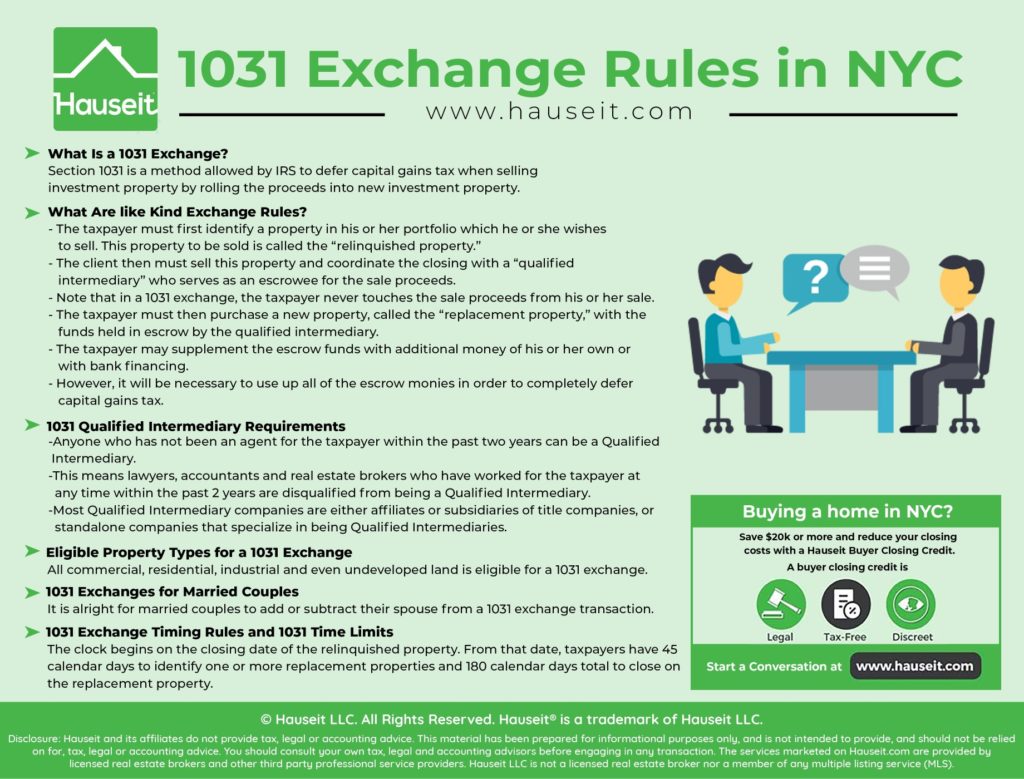

How To Do A 1031 Exchange In Nyc Hauseit New York City

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

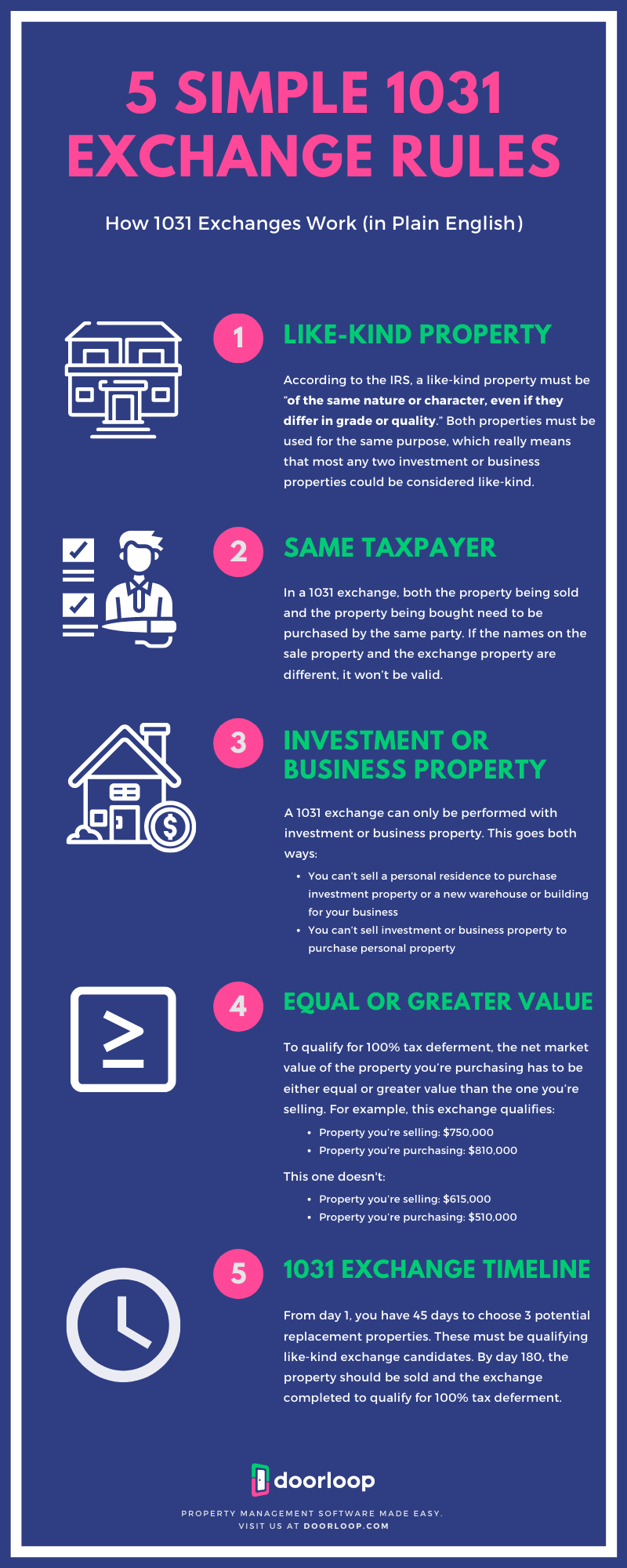

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

Irc 1031 Exchange 2021 Https Www Serightesc Com

1031 Exchange Faqs 1031 Exchange Questions Answered

6 Steps To Understanding 1031 Exchange Rules Stessa

Top 1031 Exchange Real Estate Strategy Tips For 2022 Nnndigitalnomad Com

1031 Exchange Rules Tax Deferred Exchange Manhattan Miami

Are You Eligible For A 1031 Exchange

What Is A 1031 Exchange Asset Preservation Inc

1031 Exchange What Is It And How Does It Work Plum Lending

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Exchange Mark D Mchale Associates